It’s easy to stick with investments that are leaving all other assets in the dust. In fact, logic tells us because they’re performing so well, we should buy more. While we’re at it, shouldn’t we dump the lousy performers in our portfolio as well? But logic does not make for a quality investment strategy. These emotions are what makes investing so difficult.

Additionally, when diversifying your investments, mediocrity is inevitable. Given the tear U.S. Stocks have been on, it’s a good time to talk through the risks and benefits of diversifying away from areas that have been the top performers. Despite how cliche it’s become at this point, the phrase “past performance is no guarantee of future results” is still a truth. Memories of previous bubbles seem like the distant past. Some of us don’t want to believe and others don’t want to miss out on gains any longer. Whatever the reason, it’s inherently difficult to diversify away from seemingly never-ending profits. So in this episode, we discuss the answer to why you even want to bother diversifying with international and emerging market stocks and what the results could be going forward.

Why have U.S. stocks been so tempting?

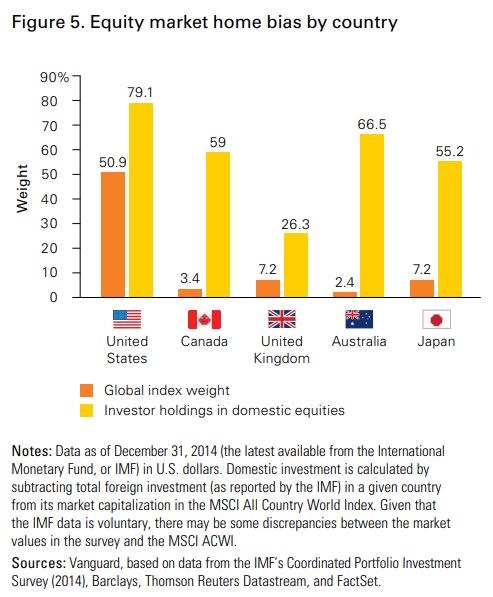

The U.S. stock market has enjoyed outstanding results over the past ten years, earning around 10.7% per year (S&P 500 with dividends through August 2018). With numbers that consistent, it’s hard to find a reason to diversify with international equities when U.S. stocks are on such a hot streak. But we live in an interconnected world, our coffee, cars, electronics, are all created across the globe. While US stocks represent just 50% of global market values, 70-75% of Americans invest solely in U.S. stocks, influenced by home country bias which is common throughout the world.

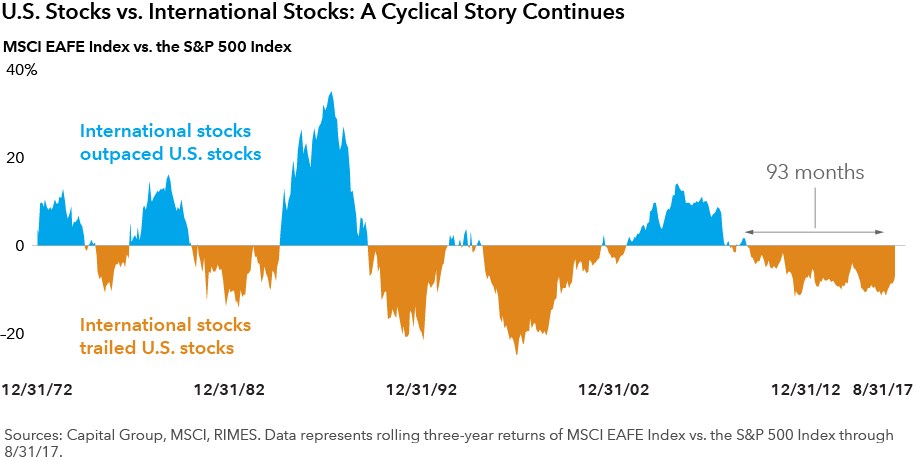

Furthermore, out of the last 20 calendar years through 2016, no country had the best-performing equity market for more than two years. As Howard Marks once said, “There’s little I’m certain of, but these things are true: cycles always prevail eventually.” A great example of this is from 2003 to 2009, foreign stocks beat U.S. Stocks by 7.3% a year (measured with MSCi ex US vs. S&P 500). Cycles will happen, which makes a well balanced diversified portfolio a sound disciplined strategy, demonstrated in the chart below from Capital Ideas.

Why would you want a mediocre portfolio?

Having diversified investments means there’s always something you’ll despise in your portfolio. This amplifies the fear of missing out on a high flying tech performer. Especially the past 10 years, where U.S. stocks outpaced foreign and emerging stocks by over 6% per year during that period, which is why it’s a challenge to remember the Lost Decade for U.S. stocks from the 10 years prior (2000-2009). Investing often makes us shortsighted. Creating pressure that tempts us to pick winners when markets aren’t going our way. Even if diversification feels mediocre, it increases the reliability of longer-term outcomes. Allowing you to have winners in all types of market cycles. Because being right about investing in the best returning asset class can blind us to the reality that it will revert back to the mean.

What are the risks of investing internationally?

We highlight four major risks when dealing with international investments in this episode. Tariffs and trade wars have dominated the news cycles of late, but so far it’s more talk than action. Equity markets often react to short-term noise based on overblown fears and exuberant hopes. Currency fluctuations will affect the value of your foreign returns as well. A rising dollar against other currencies will hurt foreign stocks. We also discuss economic and geopolitical risks in many areas of the world. Yes, there’s always a reason to avoid investing in poorly performing areas, but valuations should be considered. We mention and link an article below discussing the historically high correlation of valuation metrics with 10 year future returns. So despite the risks, this research raises some interesting questions about the prospects for international and emerging stocks going forward. But this requires discipline and diversification. The type of discipline that you could question for years. Likely the same way most investors were questioning U.S. stocks prospects in 2009. We’ve all seen how that’s turned out.

Outline of This Episode

- [1:27] How and why you should diversify your portfolio

- [6:30] When you diversify you will have a more mediocre portfolio

- [11:32] Why aren’t people investing in international stocks?

- [17:55] What are the benefits to investing internationally?

- [22:05] We have no idea what will happen in the future

- [25:22] Have a disciplined approach to investing

Resources & People Mentioned

- Article – Research Affiliates – CAPE FEAR: Why Cape Naysayers Are Wrong

- Article – Capital Group – The State of Global Trade Tariffs in 6 Charts

- Article – Should I Own International Stocks?

- Article – A Wealth of Common Sense – Diversification is No Fun

Connect With Chad and Mike

- https://www.financialsymmetry.com/podcast-archive/

- Connect on Twitter @csmithraleigh @TeamFSINC

- Follow Financial Symmetry on Facebook